In the year under review the merger of DFCC Bank with its former subsidiary DFCC Vardhana Bank, bore fruit. While there were barriers to be overcome in the process, we have emerged, strengthened and better positioned to serve our clientele. We continue to provide the full gamut of development and commercial banking products and services, but now under one roof.

In the course of its journey of over six decades the Bank has grown and evolved through developing rural economies, supporting and sustaining livelihoods and creating employment opportunities in every district in Sri Lanka. In the process we have nurtured entrepreneurs and SMEs. While we have expanded our reach through our brick and mortar network, we have also done so through innovative non-traditional means. This has been facilitated by blending our banking know-how with cutting edge technology in developing products such as the Vardhana Virtual Wallet (VVW).

We have broken new ground in the sectors we have funded such as renewable energy. In addition, through our subsidiary companies we have developed complementary services such as consultancy services, industrial park management, information technology, investment banking and wealth management.

In the year ahead we hope to build further on the foundations we have laid. DFCC Bank has been rebranded and repositioned on a platform of sustainability. This will be facilitated by implementing the ‘Eleven Sustainable Banking Principles Developed for Sri Lanka’ . We will thus be well positioned to target new market sectors particularly in the mini, micro and retail segments.

We have the fullest confidence that the Bank will continue to forge ahead in the years to come, utilising its human resources and technological competencies to contribute to the economic and social development of Sri Lanka, by continuous improvement and innovation in its products and services.

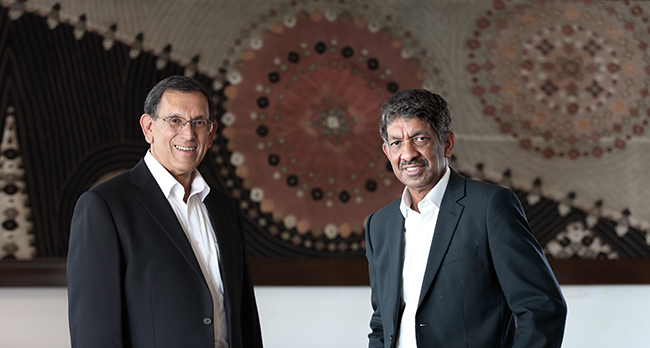

C R Jansz

Chairman

Arjun Fernando

Chief Executive/Director

It was not the best of times, nor was it the worst of times, but it will be remembered as one of the most momentous of times for DFCC Bank PLC. This paraphrasing of the opening lines of ‘A Tale of Two Cities’ by Charles Dickens aptly summarises the events of year 2015.

While posting a mixed bag of financial results, the much-anticipated formalisation of the operational merger between DFCC Bank PLC and its subsidiary DFCC Vardhana Bank became effective on 1 October 2015 through an amalgamation of the two banks. The transition was smooth and seamless and the surviving entity is DFCC Bank PLC (“Bank”).

We trace our origins to the establishment of Development Finance Corporation of Ceylon (DFCC) in October 1955 with a mandate to spearhead development financing in a newly independent nation. DFCC, which later became known as DFCC Bank and finally DFCC Bank PLC, evolved and grew with the times to celebrate its Diamond Anniversary in October 2015, which also coincided with the amalgamation. A happy augury indeed!

Our relationship with DFCC Vardhana Bank dates back to 2003 when we acquired a 94% equity stake in a fledgling commercial bank – then known as MERC Bank – to complement our development banking business.

We now bring together the best of two banks – a unique blending of a 60-year heritage in development banking skills with the dynamism of one of the fastest growing commercial banks in the country. New thinking is pervading the internal mindset and a paradigm shift is taking place in customer experience. Novel electronic delivery channels such as Lanka Money Transfer and Supplier Settlement Service, a digital Mobile Wallet that fosters financial inclusion and the rebranding and relaunch of DFCC Bank’s brand are some visible examples of the innovations and change that are taking place.

We are embarking on an ambitious five-year strategic plan that will position the Bank in the upper quartile of the local banking industry. It will be underpinned by diversifying our distribution channels, increasing the use of digital media and building further on our cautious expansion into foreign markets.

Well poised to take advantage of the new era of opportunity, we will ensure that the Bank will grow with you, for we have always been a bank that grew with our customers, rather than because of them.

Let’s keep growing!

DFCC Bank celebrates sixty years of development banking this year...a Diamond Jubilee milestone which encapsulates the saga of a pioneer that has ventured boldly where not many have gone before.

Our yardstick of success is not just the number of projects financed or the amounts lent, but also about partnering trail-blazing ventures and supporting new economic sectors in the country. In the 1960s the Bank commenced financing the nascent tourist industry that led to Sri Lanka's first ever beach resort hotel. The next decade saw us busy with the take off of the country's export-driven apparel sector. Later on it was financing the country's first mobile telecoms operator, which was also a first for South Asia, and then on to spearheading private sector participation in renewable energy based power generation in Sri Lanka.

These projects and sectors were facilitated through high risk term loans, advisory services and even direct equity participation. Going beyond mere provision of finance, the Bank addressed necessary institutional, technological and regulatory barriers and developed innovative risk mitigation mechanisms to undertake such activities. Today, these sectors have become mainstream businesses that sustain the national economy in many ways.

Times change, and we with them, but all the while holding fast to our roots. The Bank has evolved, diversified and grown to meet the changing needs and aspirations of a resurgent economy, its institutions and its people through a unique business model. It is one that seamlessly integrates the development banking business of DFCC Bank with the commercial banking business of its 99%-owned subsidiary, DFCC Vardhana Bank through an operational merger. We call it the DFCC Banking Business.

Our next phase of evolution will be to cement the businesses of the two banks through a legal merger, subject to approvals. Going forward, this amalgamated entity will exploit the strengths of the respective banks while exploring new opportunities, thus triggering yet another cycle in our evolution.

Whatever the outcome, we will not lose sight of DFCC Bank's origins and the spirit in which it was founded 60 years ago. We are, and always will be, concerned with ‘much more than money’.

Royle Jansz

Chairman

Arjun Fernando

Chief Executive